Feeling grateful for agency over time

Plus interest rate cuts, stress saving and writing a cover letter.

Travelling for work sounds glamorous, but I’l do my best to avoid it as much as possible. Why? Two reasons; 1) it breaks up any semblance of routines I have (crucial for remaining slightly grounded in the chaos of life) and, 2) you lose agency over your time.

I returned last night from a full week away at a conference. One upside was that I spent hardly any of my own money (since most of it was being paid for by the company I work for). But the downside was that I lost agency over my time — something I value incredibly highly.

Still, I get to experience the contrast of that with a day, and a sunny one at that, with zero plans. And getting to luxuriate in, and feel grateful for, it, with a heightened level of appreciation.

With that, I’m off to have a nap. Happy Sunday.

1. UK interest rates were cut for the second time this year

The last cut was back in August, and the Bank of England had said there would be another cut this year (plus more next year) so it wasn’t surprising news.

That said, it’s expected to go a little slower on interest rate cuts after the budget. This changed outlook, plus competition among challenger banks for savers’ cash, has resulted in some providers actually upping rates on their new fixed-rate savings bonds.

Almost a third haven’t switched in the past five years - so this is your regularly programmed reminder to move your money to a high-earning product.

2. Are you a stress saver?

Much has been said about doom-spending — the tendency to impulse-buy things as a distraction from your problems — but research finds that people actually tend to decrease their spending when they’re stressed.

An overhaul of your finances can only go so far; it is not going to fix corporate greed or price-gouging or the cost of housing or who’s in charge.

But it can bring a sense of control. If it works for you.

This is super interesting; “This is a very uncertain time for many people, and since money can be a tool to provide us with more certainty and security, it’s natural for people to reexamine their financial choices,” says Farnoosh Torabi, a podcaster and money writer. “‘What now?’ is on repeat in my DMs, especially from women.”

We have no idea what’s going to happen in the next four years and beyond. But don’t sink into helplessness. Make some changes, however small. In fact, small may be better! It’s impossible to be fully prepared for whatever’s coming, but there’s no point in making yourself feel worse about it, either.

(Full disclaimer, I have pretty much copied and pasted bits from the article itself; I’m still very sleepy and getting something out, rather than missing another week of publishing, was the priority!).

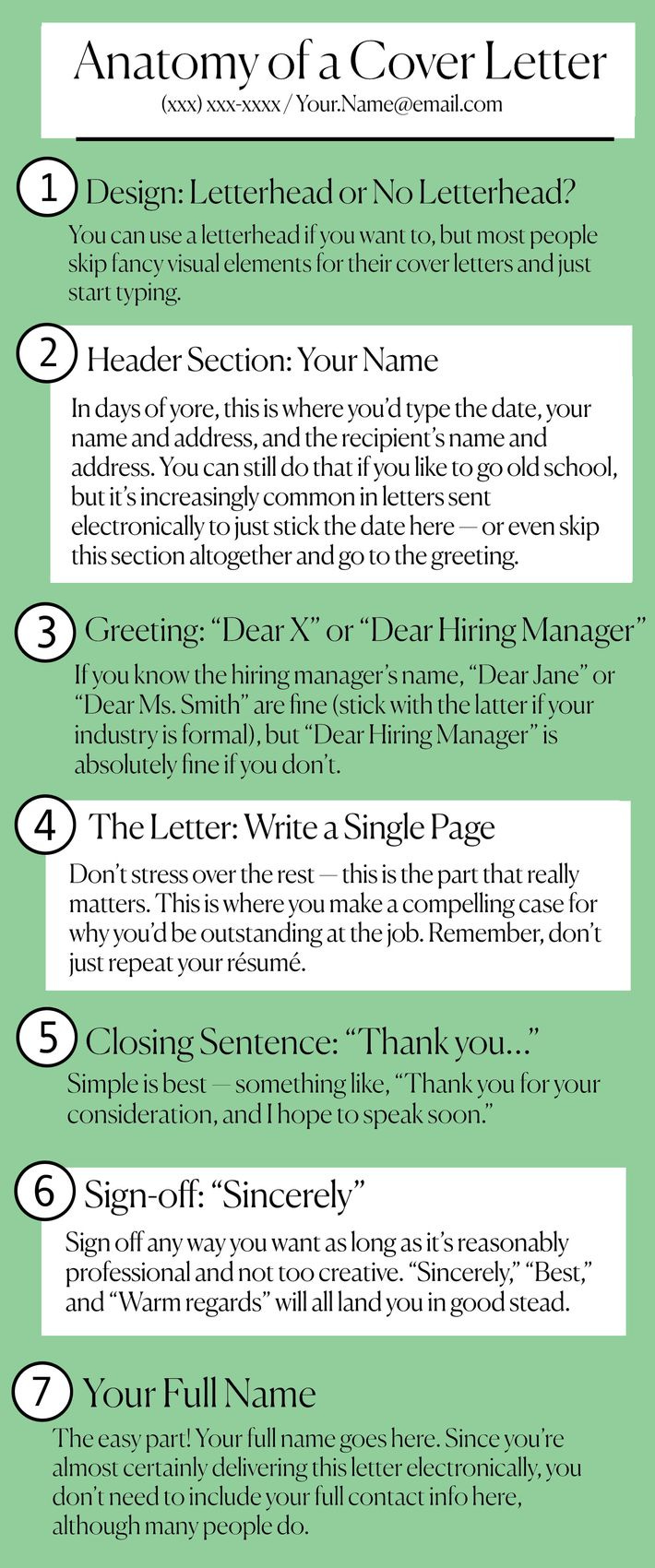

3. How to write a cover letter that will get you a job

Don’t just rehash your CV - pretend you’re writing an email to a friend about why you’d be great at the job

Show, don’t tell - don’t say you’re organised, talk about the system you implemented and the impact it had on the team or business

If there’s anything unusual or confusing about your candidacy, address it in the letter

Keep it under one page

Don’t agonise over the small details

Links

There is a toy called a ‘Fart Blaster’ and it’s predicted to be the biggest selling toy over the Christmas period. It smells like popcorn(?!). Monthly spending by parents on gifts for children has increased steadily - it was £61 a month in 2021 to £82 in 2024. A month(?!). But this year’s most expensive toy is £80, lower than £100 last year. This is because spending is spread across multiple smaller value toys, rather than one big item.

Why turkey gets cheaper over Thanksgiving (and I would assume the same thing happens over Christmas too). This concept is called a ‘loss leader'; subsidising the wider basket of items the consumer purchases, through getting them through the doors. One study found that just 2% of shoppers go into a store and purchase only the loss leader items — the rest fill up their grocery carts with other profit-making items.

US buy now, pay later giant Affirm launches in the UK. It’s founded by an ex-PayPal founder, Max Levichin, is offering payment instalments over up to 12 months (rather than 3 or 4 months like Klarna and ClearPay) and is expected to keep growing its UK team.

A reminder that the final Money Brunch of the year is on 30 November, sign up here or message me to join!

And a promise that the stock market investing summary from the last session is actually coming out very, very soon.

Know someone who would enjoy this in their inbox on a Sunday morning?