Last week, I included a story which surveyed UK adults and their use of AI in managing their finances. 40% of respondents had “used a generative AI tool such as ChatGPT or Gemini for personal finance advice.”

Financial advice is so highly regulated that it’s near impossible to get good counsel from experts or digital tools. Unless you’re able to pay for a good adviser, who is well versed in your specific situation.

This means that many people - the majority of the population, in fact - don’t have access to good guidance. Or, more commonly, any advice at all. If you don’t have someone in your life who can share some knowledge with you, or the level of interest that means that you’re committed to delving into personal finance regularly (🙋♀️), you miss out on engaging with financial systems to build wealth.

My view is that everyone has unique lives and financial situations, but they can likely benefit from access to information that’s relevant to them, and also learn from other people’s experiences. I think that tech can solve a big part of this problem. It’s why I spent a few years trying to get a startup off the ground that would do that but struggled to get the funding to build it, to prove that people would want it, and demonstrate how to navigate regulation around advice.

Now, with gen AI, people are taking matters into their own hands. Here are some insights from some of the Money Brunch community and readers on how they use it:

“I’ve used it to help me understand financial terminology/concepts but not for financial planning”

“I’ve used ChatGPT to help with personal finance - it’s like having someone explain everything to me and strategize for me in the simplest lingo possible”

“I’ve used ChatGPT to analyse stocks and to help me build an investment portfolio that meets certain financial goals”

“I ask it for stock recommendations (then double triple check their recommendations) - and comparing credit cards”

“I’m relatively new to the country. So I wanted to understand the tax trap in the UK and what options can I explore to address that. I used Claude and it was hallucinating a few things. I could catch them only because I know some facts from before. So when I pushed Claude for the source, it corrected itself. It was helpful to discuss in context multi country tax years and double tax avoidance etc”

This last point illustrates the biggest issue; hallucinations. These models literally make stuff up, but say things with such confidence that we believe them. Our brains respond to them in a human way. To interrogate the information you’re given, and drill right down into the truth, takes time.

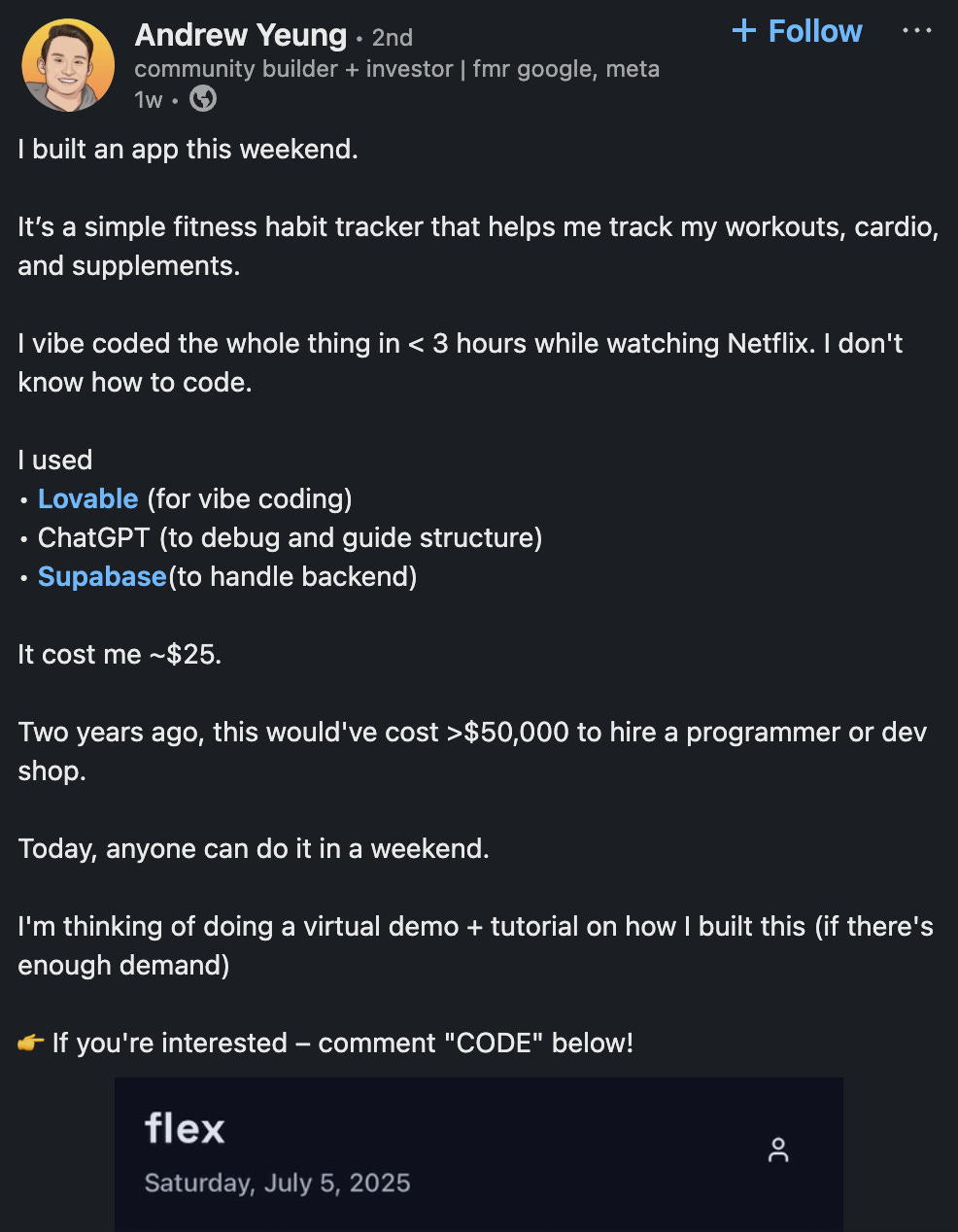

Elsewhere, this week, Lovable, an AI chat-powered app builder for non-coders raised $200m. Examples of how people are building apps tailored to their needs - without any dev experience - are popping up in my LinkedIn feed.

It means that we have more options available to us to create solutions that work for us. It does mean that we need to be really clear on the financial problem that we want to solve, what the tool should look like - and then invest time and money into building it.

Not heaps of time and money but, still, it adds up.

It cost Andrew Yeung around $25 to build his health and fitness app. No doubt this isn’t a one-off cost; everything requires a monthly subscription these days. So even if it’s $15 a month, that’s $300 a year.

And it requires some expertise. And a lot of time, that many don’t have. Arguably further increasing the financial advice gap.

1. The UK Government’s planning to make us invest more, with an ad campaign…

So it finally happened. The Mansion House speech1 took place on and, as we knew, Cash ISAs remain untouched. For now. The Chancellor said she will “continue to consider further changes to ISAs.”

But it wasn’t the only policy idea the team had to get us investing. We know now what else was in the mix, and made the cut, including:

In January, a report will outline how risk can be better communicated, so that these warnings don’t scare people off (I will be very interested to see how they profile different people; those heavily investing in crypto, or responding to ‘finfluencing’, for example, have very different mindsets to those who simply won’t engage, and prefer to hold cash)

In April, there will be an ad campaign communicating the benefits of investing

There will be ‘brand new targeted support for consumers’ ahead of April (this will be very interesting)

Banks will be able to encourage those with cash sitting in low-interest accounts to invest instead

Long term asset funds (LTAFs) will be eligible for ISA. These invest in private assets from infrastructure to start-ups, but are way less liquid (i.e. harder to convert into cash, or another asset) than other products; they require 90 days’ notice to withdraw your money. This is getting some pushback from investment platforms

The Government wants to get people to invest more, so that their wealth can grow.

“For too long, we have presented investment in too negative a light,” said Reeves, “quick to warn people of the risks, without giving proper weight to the benefits.”

2. Buy now, pay later (BNPL) is getting regulated

From July next year, companies like Klarna and Clearpay will have to carry out affordability checks on people before giving them access to credit. Currently, you can split pretty much anything into three payments. Fine if you pay back on time, not fine if not; you pay interest.

But, until now, BNPL has sat outside of credit regulation. Which is wild.

The Chief Executive of StepChange (a debt charity) explains the issue clearly: “Buy now, pay later users are twice as likely as all credit users to borrow to cover essential bills…. BNPL is now as common as using an overdraft amongst UK adults.”

This is going to have an impact on people, but also the companies themselves.

Over 10 years, regulators estimate consumers will be £1.8bn better off as a result, and companies will lose out on £1.4bn of profits.

3. How to split expenses with friends on a group trip

I haven’t done a group trip in a while, but I know they can be challenging. And money plays a role. Some things to consider:

Understand everyone’s budgets before booking (take note, hen party organisers)

Appoint someone to look after money “vacation CFO”(!) - and set some rules about how things (like dinners) will be split (these rules are for discussion with the group, ofc)

Use Splitwise or Splitr, or similar

Prepare for some conflict

If you’re in a position to pay more than others, do it! But don’t make a big deal of it

Give people opportunities to bow out - and be gracious when they do

Links!

Money

The cash v card debate. Events such as the Iberian power blackout have led some to go back to physical money, but others are not convinced.

Prime Day isn’t designed to help you save money. It’s designed to make you feel like you’re saving money, while quietly draining your bank account in $17.99 increments. It’s capitalism’s version of a scratch-off ticket: flashy, addictive, and mathematically engineered so the house always wins. So spot on,

A first person story: Why we’re going — and staying — in debt for quality child care.

Markets

Careers

Employee share ownership plans: how to spot a bad one.

Culture

This piece from October was circulating on Substack, prompted by the ‘Coldplay affair couple’ situation. “There’s been a rise of people referencing how the combination of our phones and social media have created a surveillance culture and transformed society into a permanent panopticon2.” Cannot recommend this enough

“Instead of focusing on the healthy, sustainable future of the company and meeting the needs of our loyal fan base, I rode a temperamental wave of appraising investors — some of whom seemed to have an attitude toward equity and “betting big on inclusivity” that changed its tune a lot, to my ears, from what it sounded like in 2020.” The founder of Black beauty brand, Ami Colé, on why she’s closing her business.

On my radar

I finally listened to Addison Rae’s well-received new album and enjoyed it! (If you like Lana, Charli, Taylor, and singers who enunciate properly, give it a whirl). Being a pop music nerd, I dug into who made it. The answer, Elvira Anderfjärd and Lukas Kloser (and Addison; the three are the sole writers on the album). “The album is proof of what can happen when young female creatives are allowed to steer the ship.”

I finished reading Anna, the biography of Anna Wintour by the brilliant

. This view of a laser-focused (and blinkered) individual, building and wielding their power - collected through interviews with people who have known her - was timely, given recent news about her non-retirement, non-resignation from Vogue (she’s stepping down as American Vogue’s Editor-in-Chief, but still controls the Vogue brand, and content across Vogue’s publisher, Conde Nast). Really looking forward to reading Amy’s new book on Gwyneth Paltrow at some point!

Sundays: Money and coffee. What more do you need?

An annual speech given by the Chancellor to City bosses at Mansion House, a historic building in the City of London and the home of the Lord Mayor of London (it’s very nice)

Panopticon: A prison with cells (= rooms) arranged in a circle, so that the people in them can be seen at all times from the centre