For many of those who celebrate Diwali, cleaning is a big focus of the preparations (along with making lots of (typically deep fried) snacks too - including chakli, ghoogra, chevdo (Bombay mix)). After last week’s dancing and Money Brunching, I (eventually) got round to starting the deep cleaning process.

This is something I’ve grown up with, and I do like having an annual check point to clean the inside of every kitchen cupboard, scrub the outside and top of said cupboards, move furniture and clean every inch of floor space, wipe down the skirting boards, clean the oven and washing machine…

I prefer doing this in the autumn to the spring, when you can harness that post-summer burst of energy (TikTok is apparently calling this October theory).

What I’ve learned from a week of cleaning:

It takes ages

You get to understand what’s going on with your home; spotting any wear and tear before it turns into a bigger problem (and costs more to resolve)1

Honestly, how does one task take so long?

You pass a lot of time without spending anything(!); time spent at home - off the internet - is a great money-saving hack

It’s an exercise in mindfulness, as you’re just focused on the task at hand

It is all-consuming, which means that your social plans or plans to get more (paid) work done or, more importantly, leisure plans, go out the window

It’s the most satisfying thing when it’s done. But it’s never truly done; there is always something else to do

Excellence in home management has long been something that’s been expected of women. But, despite having far more requirements and desires for how we use our time, it’s something everyone still needs to spend time on.

Like with money management, I think it falls into two categories:

Small and often - things you do on a daily, weekly or monthly basis to keep everything ticking along

The equivalent of vacuuming once a week

Think, checking your spending for anything untoward, and moving money into savings and investment accounts when you get paid etc

Bigger and seldom - things you do on a quarterly, bi-annually or yearly basis

The equivalent of cleaning your oven

Think, reviewing your investments to check that they’re performing as you’d like, and rebalancing your portfolio (a fancy way of saying ‘making changes’)

But, back to home management. With the weather getting colder, the chance of frozen and burst pipes increases. Every year, Martin Lewis (🫶) reshares his guide to finding your stopcock (this is not an innuendo!).

Which leads me to ask…

(I'm Option 2 - I have a vague idea - but I will actually look into this next week)

1. One in three retirees are in debt - and owe an average of £17,000

One of the things here is that debt is categorically viewed as a bad thing - and, actually, I’d argue that it can help make your money go further. For example, taking out car financing (leasing a car) rather than buying it outright means that you now have £10k (an example number) you can put into savings, investments or paying down higher interest debt.

Yes, it means that you have to pay interest but if you can make the monthly repayments with no issues, I think there’s a role for debt to play.

However, the concern with retirees having a lot of debt is that their income is not always going to cover paying this off.

The article then goes on to talk about equity release (since the survey was done by an equity release provider) which is something to be cautious about. It’s using the equity you have in your home and converting it into cash; there are lots of offerings around but, generally, it’s viewed as a risky road to go down.

2. NS&I to cut Premium Bond prize rate to 4.15%

NS&I is a way for consumers to put their savings into government-backed bonds and, instead of getting a regular interest payment via its Premium Bond product, you have the chance of winning some money. It’s like the lottery, kinda. Awards are still roughly in line with how much money you have in Premium Boinds - someone who has more will likely win more prizes and of higher value, versus someone with fewer.

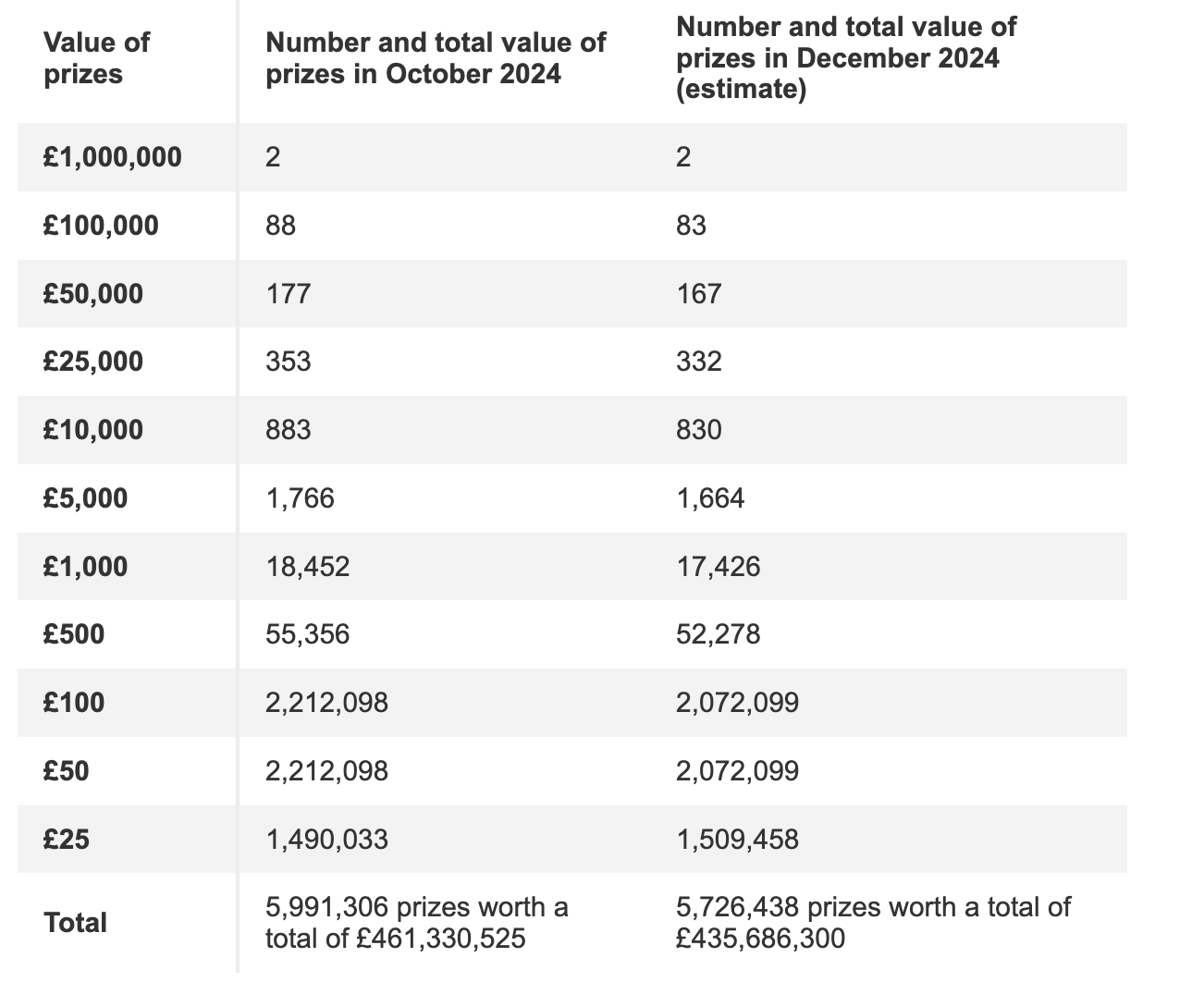

So the prize fund rate for Premium Bonds will fall from 4.4% to 4.15%. The odds of winning will reduce from the current odds of 21,000 to 1 to 22,000 to 1.

Why? Since the Bank of England’s August cut, most savings products have also started to cut the interest rate they offer to savers. And now it’s NS&I’s turn. They’re cutting rates on many of their products.

3. Starmer climbs down over claim stock owners are not ‘working people’

The Prime Minister, earlier this week, said that stock owners wouldn’t come within his definition of working people.

As a reminder, Labour’s manifesto said the party wouldn’t raise taxes on working people. So this comment hinted at the fact that anyone with investments in the stock market would mean that someone couldn’t qualify as being a ‘working person’ and therefore would be hit with tax increases.

I saw something about this on Trading 212 where some people were (rightfully) outraged. Just because you work, it doesn’t exclude you from being able to invest in the stock market and become a stockholder. In fact, investing is how you get slowly out of the cycle of having to work to generate income.

Which is why he had to clarify his comments later in the week. Specifically, that people who hold a small amount of savings in stocks and shares still count as being ‘working people’ and that he had been referring to people who primarily gets their income from assets in his interview.

Links!

Around one in five people across the UK have been caught out by a finance scam in the past year, according to the Citizens Advice Bureau - who are often on the frontlines dealing with distraught people.

Water bills are set to rise by 21% a year to fund these horrendously inept and corrupt water companies with investing in upgrading infrastructure, and no doubt keep polluting the UK’s rivers and seas 😡

As many as 3.29m pension pots worth £31.1bn remain unclaimed in the UK. I know this doesn’t apply to any readers of this newsletter, right..? 😛

What’s the point of corporate art collections? Historically, they were about prestige and demonstrating a company’s success and stability.Now they’re more about develop relationships with potential customers - especially if the customers are wealthy private clients.

Why countries are seeking to build “sovereign AI.” Nvidia is working with different governments (including India, France and Japan) to help them build their own AIs. xxxx

When we joke about selling feet pics online, as it’s more profitable than our actual jobs, and it’s not really a joke. Lily Allen has said that she makes more money from selling feet pics on OnlyFans from 1,000 subscribers than she does from nearly 8m monthly streams on Spotify.

How to feel less tired on Mondays? Active rest, keeping to a sleep schedule and making Monday mornings enjoyable is key.

My mom was a magazine editor in the ’90s. We’re finally talking about what it did to our body image. This is a bit of a long-winded read, but there are some v interesting bits in there about comparing how things were then with how they are now.

Next week it’s the Budget which, based on the last few months of headlines, looks like it’s going to hit everyone. I haven’t included anything on that here, really, because it’s speculation and pre-briefings, and I would rather wait until next week’s issue.

I also know I am overdue on sending out a summary of the stock market investing Money Brunch session from last weekend - that’s on me. Cleaning took priority 😂

I have the same view on ironing clothes; doing it gives you the chance to uncover missing buttons and fraying hems, and then fixing them… eventually.