On Tuesday, I went to Wimbledon. It rained all day. To the point that I’ll soon be receiving a refund on my ticket into the grounds. On Wednesday morning, I left grey London and arrived in a sunny and hot Mallorca.

The contrast was stark. But the bigger thing that blew my mind is how difficult it was for London Bhakti to imagine what life would be like for Mallorca Bhakti.

I knew things based off existing knowledge I held; I was going to be spending most of my time at the beach, I was staying with a friend and her family, I’d need my summer clothes, and that I needed to pick up the car I’d rented.

I knew other things based off research I’d done; the weather forecast (obv), how long it would take to get from the airport to the house, that I should go to Zara…

But there were things I couldn’t have known; that the humidity would fog up the car occasionally; plans to go to the beach in the morning with my friend would fall through without fail; a group of American girls would set up camp on a beach next to me with their speaker blaring, and scupper my nap-taking plans for the day; whether or not I’d packed the appropriate number of pants.1

So it’s no surprise that we struggle so much to plan for the future, most of all when it comes to retirement planning.

We make assumptions based off research (i.e. look up ‘how much money do i need for retirement’) and our own assumed knowledge (e.g. our personal preferences). But until we get there, it’s impossible to truly know what we need.

There’s a fair bit of research to show that connection with our future selves makes us make better decisions for them. This could be through seeing a digitally aged image of ourselves, or writing a letter to Future You. Technology means that it’s surely only a matter of time before we can live out our future lives virtually, to get a taste of what this might look like.

We could see where we live, how we spend our time, what our loved ones look might look like. But there’s no way of knowing what it will be like in reality, for we cannot simulate the cumulative effects of our life experiences, nor know what life in the future will look like.

Still, doing the best we can is better than doing nothing. Let’s pack our metaphorical suitcases and hope we have enough underwear.

1. Is it better to split a pension across two providers, rather than keeping it in one?

This is a really good read, and I recommend clicking through to the article, as it explores the nuances of making decisions about your pensions.

Many pensions, like many bank accounts, are protected by the FSCS compensation scheme - it guarantees that up to £85,000 is covered in case the financial institution goes out of business. A reader writes in to ask if they should split their pension across two providers, to take advantage of this protection for their £177k pension pot.

Some key points:

‘Up to £85,000’ is a key phrase; the level of protection ranges between protecting 100 per cent of the value of the pension, to no cover at all. Therefore, it's important to understand the amount of cover you have in place for your specific pension arrangements

Pension schemes which are not protected by the FSCS may be protected by the Pension Protection Fund or Financial Assistance Scheme instead

Money held in pensions is typically meant to be kept separate from the rest of the company, so should be protected even if the company fails

There are lots of regulatory checks and balances in place to make sure this happens so, realistically, the chance of a pension providers failing and losing money that should have been ring-fenced is quite low

The level of cover available in the event of a provider failing is an important factor, but it's not the only one that needs to be taken into consideration.

Other considerations are:

Some pensions have valuable benefits that are lost on transfer and cannot be replicated with a new provider

Differences in charges and fees between the old and new providers

Having more than one pension provider adds administrative complexity - this is going to have an impact when you start to take money from the pension, rather than while you’re paying into it

2. How to negotiate a higher salary after a job offer

Research salary ranges before your first interview, so that you can answer the question about salary expectations

If they’re not bringing up salary, make sure you ask (politely) what their ballpark is, before investing in a multi-stage interview process

When you want to counter-offer, you don’t need to present an elaborate justification for why you’re asking for a higher salary - just outline what you want

Most of the time, it’s smart to ask for more money (around 10% is a safe bet)

If you ask for more money and the answer is no, you can still accept the job if you want it!

3. Martin Lewis (🫶) is a celebrity

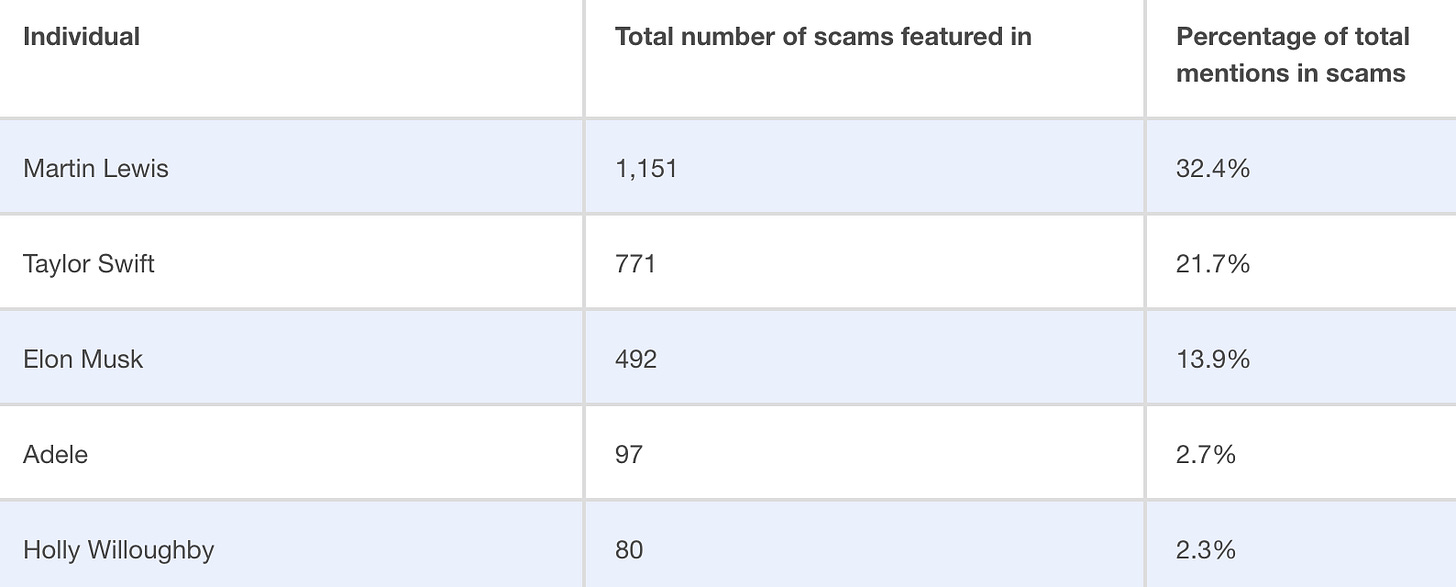

If you see an online advert, particularly if it features a celebrity, always assume it could be a scam. In the UK, the five top most ‘scammable’ celebrities are:

The top three, I get. But then the list starts to get way more niche. Holly Willoughby at number five?!

The types of scams:

Mentions of cryptocurrency, investing, retirement planning and promises to get rich quick

Claims there's been a scandal involving the celebrity to get you to click through, and then take you to an investment scam

Tickets being sold at a discount or for sold out events (hence the big artist names - also listed are Ed Sheeran, Rod Stewart and Lewis Capaldi)

If something looks too good to be true, it probably is!

✨ Other things! ✨

MONEY

After years of resistance, UK insurer Direct Line is now going to be available on price comparison websites

From next year, if you’re driving from south east to north east London, you’ll have to pay to drive through the Blackwall and (soon to be opened) Silvertown tunnels (£4 peak, £1.50 off-peak)

LIFE

There may be a sequel of The Devil Wears Prada in the works…

Re-energised and seeking a thrill – inside the rise of the 50+ woman adventure traveller (discovered this via

)

MEDIA I HAVE CONSUMED

The new Beverly Hills Cop movie on Netflix is so good (if you liked the originals)

Romantic Comedy by Curtis Sittenfeld, is a book about a regular person developing a relationship with a Famous Person (in a similar vein to The Idea of You), a nice book to pass the time but not something I really got into. A shame, because I loved her novels Rodham and American Wife and I love romcoms!

I am endlessly fascinated by pyramid schemes and this podcast episode looks at Tupperware parties, multi-level marketing schemes and critical theory (which stretched my brain in a good way) (Apple / Spotify)

Two music recommendations from

I listened to Brat and it’s the same but there’s three more songs so it’s not by Charli XCX to see what the fuss was about and it’s broadly very good but also silly, and some of it was a bit meh

I loved listening to Arooj Aftab’s Night Reign album (especially the non-English tracks)

Thank you for reading!!

As a reminder, nothing I say in this newsletter should be taken as personal financial advice.

Know someone who would enjoy this in their inbox on a Sunday morning?

The underwear, not the trousers.