Yesterday’s Money Brunch was an interesting one for two reasons:

It was the first time I wasn’t there in person (as I was away on a last-minute trip)

And, it marked one year of Money Brunch 🎂

The first one took place on Saturday 11 March 2023, and I brought a few of my friends together. A couple more of those, and I bit the bullet and started a Meetup group.

From there, we’ve grown a bit! And it’s been an honour to connect with so many women who are open to sharing their stories and learning from each other (including Malavika, who’s working on this with me!).

This is in a week where there’s been a story about how a third of people feel their finances are negatively affecting their wellbeing. Plus it’s been Debt Awareness Week, and some of the figures and stories are horrifying.

The financial system is not set up to serve regular people. And we’re also expected to be good citizens, friends, daughters, partners, mothers, coworkers, bosses - and to do and have it all.

For this reason, working towards financial freedom can easily fall down your list of things to do. But the fact that you’re reading this, are engaging with this community and prioritising yourself is SO impressive 💜

1. How to invest in an ISA to actually earn income

If you read one thing, read this.

I think lots of us know that we need to set ourselves up with passive income streams. But we’re rarely shown how this actually works.

That’s why this article is very much worth your time. It covers some of the practicalities.

The key points:

You’d need around £225,000 in your ISA to achieve a tax-free income of £10,000 a year

If your investments grew by 5% annually, you’d need to put in £1,450 a month, or £17,400 a year, over ten years (this is of course super ambitious for some, but could be something to work towards)

You need to pick income generating products, and this is measured by their yield

To get to this £10k figure, you need to be targeting a 4.55 per cent return for your overall portfolio

The article lists out a few options you could look at

If you buy funds, choose the 'Inc' version - Inc is short for Income (the other option is Acc for Accumulation - ie the money is reinvested back into buying more of the fund)

An accumulation fund is better for building up your portfolio, but an income fund will pay you cash ready to spend if you choose

To do this, you’ll need to go with a DIY investing platform - where you pick your own products. The article lists out some, and you can always check out Money Saving Expert for its list too (🫶).

2. Robinhood comes to the UK

It tried (and failed) to do it in 2020, but successfully made it across the pond in 2024.

Robinhood, the trading app, gives users the ability to trade US-listed stocks, so you can buy stocks in companies you’ve heard of (think Apple, Domino’s Pizza, Google, JP Morgan Chase), plus loads you haven’t heard of.

This is big news for people who love trading - and probably have maxed out their Stocks and Shares ISA allowance. If you’re under the £20,000 ISA limit, you’re probably best finding somewhere that offers that ISA wrapper for your stocks.

What makes Robinhood attractive is that it offers low-zero fees and you can earn 5% interest on uninvested cash that you have on its platform.

I think the other thing that makes it attractive is the brand name; lots of people have heard about it, even if it is just because of its involvement in the GameStop stock price shorting that happened because of some Reddit users.1

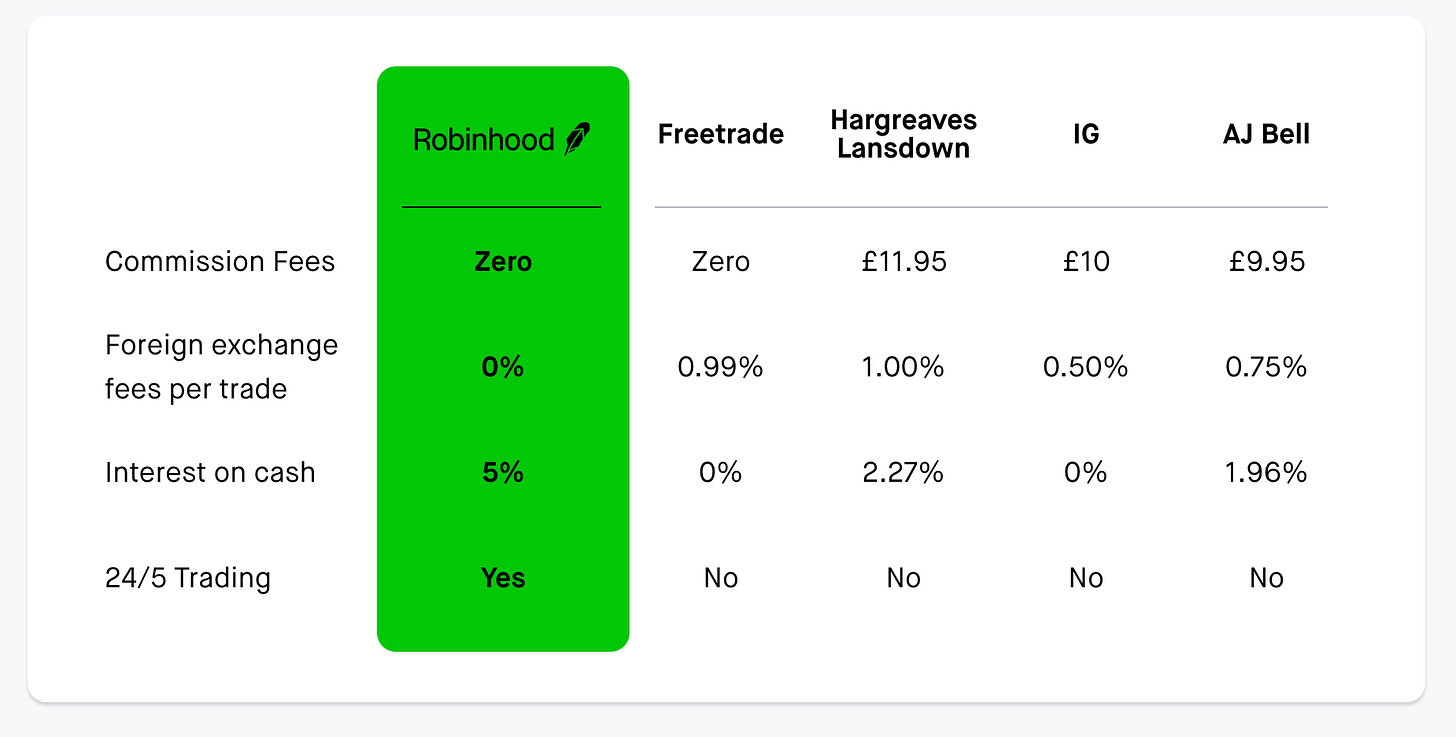

This is how they compare themselves to their competitors:

BUT the real competitor is Trading 212 (which conveniently doesn’t make this list) - it offers the same fees, and 24/5 trading - plus a 5.2% interest rate on cash.

PS Shout out to Money Bruncher, AG, for sharing it in the WhatsApp group earlier this week.

3. What’s WASPI and what does it mean for you?

One of the big headlines this week is that the group, Women Against State Pension Inequality (WASPI), has successfully campaigned to get compensation from the government, for changing the State Pension age.

Why is this happening?

Almost 4 million women born in the 1950s planned for their retirements, expecting to get the State Pension aged 60. But this was moved to 65, and then to 66.

Leaving a 5-6 year period for them to stretch their finances over.

So what now?

Well, it’s not actually great news. Campaigners were asking for £10,000+; the ruling said payouts should be between £1,000 and £2,950 per person.

What’s more, the Department of Work and Pensions has said it won’t pay out this money. So the Parliamentary and Health Service Ombudsman (PHSO), which made this decision, is asking Parliament to intervene.

Why is this relevant to you?

As a population, we’re projected to live until 81. And women tend to outlive men, meaning we need to get our finances to last longer too.

It’s a reminder that the State Pension isn’t something to be super reliant on, particularly for younger workers (as it’s likely the age requirement will have to keep going up).

While you have time, invest in your own future 💪

See you next week!

You can read about what happened here. And/or you can watch the movie version of the story - Dumb Money is available on Netflix.