Making tax less taxing

Here's a summary of what we discussed at the May Money Brunch. Plus links to this week's stories.

It’s a sunny Saturday morning, and there’s a table of pastries and coffees. We’re at Ole & Steen near Victoria, connecting with new faces, and re-connecting with familiar ones.

One of these faces is Veshali Patel, founder of Pinnacle Advisory Services, accountant and Money Bruncher 💜

And we’re here to talk about tax.

“Dealing with HMRC gives me anxiety.”

“I’m scared of getting something wrong and being penalised for it.”

“Tax systems don’t feel like they reflect today’s social and economic realities.”1

These are paraphrased remarks, but feel representative of how many of us feel about tax.

Here are some of the key takeaways.

How tax works

You pay tax on:

Money you earn (income tax)

Money you make from assets (capital gains tax)

Money you inherit (inheritance tax)

Money you spend (VAT)

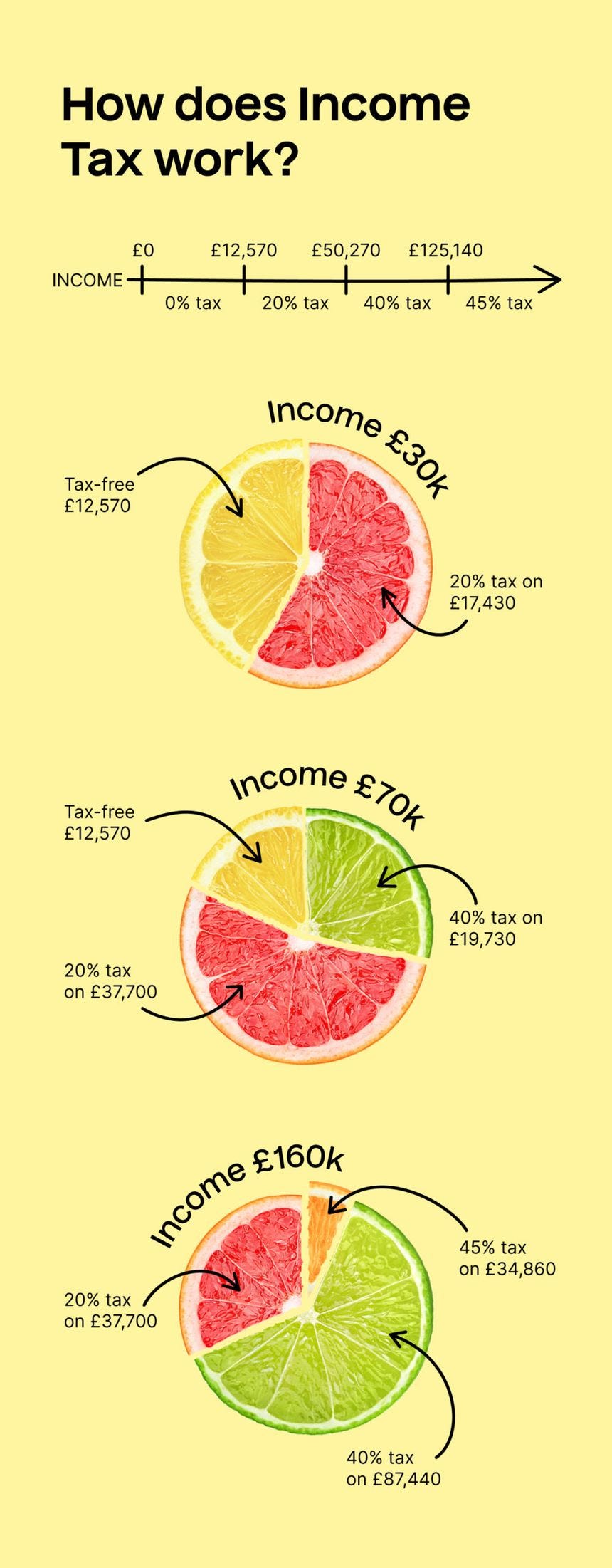

Income tax is the most relevant to most of us - and this infographic illustrates how the different bands work.

You also have tax free allowances for different things each year:

Your first £1,000 earned from interest on savings (excludes anything in a cash ISA)

Your first £500 earned from dividends (but only for earnings outside of a stocks and shares ISA)2

Your first £1,000 of income from self-employment - this is your ‘trading allowance’ and applies to ‘side-hustle income’, like selling things online

Your first £1,000 of rental income from a property you own

Then, your highest tax band is going to determine how much you pay in other types of taxes, above the tax free allowances.

Easy!

Now let’s look at some tax considerations for a few common scenarios.

Lowering your income tax liability

Your income tax is calculated by this formula:

Total income (including salary, bonuses and benefits in kind) - Pre-tax outgoings (Pension contributions and salary sacrifice) = Taxable incomeSo maximising your pension contributions is one way to reduce your taxable income.

Salary sacrifice - where you give up getting some of your salary and divert it to a non-cash benefit is the other way. You can do it through different avenues:

Pension contributions: Employees can sacrifice a portion of their salary to contribute to their pension pot. This can result in lower tax and National Insurance contributions.

Childcare vouchers: These can be used to pay for registered childcare. Vouchers can be received tax-free up to a certain amount each year.

Cycle-to-work schemes: Employees can sacrifice part of their salary to buy a bike and cycling accessories.

Technology equipment: This can include laptops, tablets, and smartphones. These can be used for work purposes and are often provided tax-free or at a reduced cost.

Company car schemes: Some employers may offer salary sacrifice schemes for car ownership. The car is usually leased by the employer on behalf of the employee.

This can be taken advantage of if:

You work for an employer where they offer it (always speak to HR and ask about which benefits they have available)

You are the director of a business

If you’re employed by someone (i.e. are on PAYE)

Your taxes are calculated by your employer and come out from your wages directly, so you don’t have to worry anything (theoretically)

The tax system will assume that you’re in the job for a year so it will split your income tax across 10 months (and National Insurance contributions across 12 months)

If you are only in a job for a short while (like a student working over a summer), you’ll need to chase HMRC for a refund. Or hope that they figure it out at the end of a tax year and send you a refund

There are some instances where you might need to file a self-assessment tax return even if you’re on PAYE:

If you earn over £150,000 (previously £100,000) you also need to file a self-assessment return, because HMRC’s systems can’t compute salaries at this level(!)

If you earn more than £1,000 from a side-hustle

If you give a lot to charity; these donations can be deducted from your income

Your responsibilities:

Check you’re on the right tax code - everyone should be on 1257L - which ensures you get the £12,570 personal allowance of tax free income

If you’re on a BR (basic rate) tax code, that’s an emergency code, which means that everything is taxed. After a couple of months, the system should clock your correct code, and over the tax year things should even out

It’s why it’s so important to make sure your new employer gets your P45 from your old employer when you change job. This means that they should have the correct tax information for you, by knowing what you’ve paid already in the tax year, and therefore what band of income you should be in

If you have a business

As a director of a business, you have to file a self-assessment tax return

There are benefits to setting up a business for something like a rental property - bought by the business (and not transferred from a personal name) - where you don’t need the rental income as part of your income

You can keep the outgoings and income in the business, and, over time, the mortgage will come down. But you’re not touching anything

And, when necessary, you can still draw dividends (which are taxed at a lower rate than income)

Other things to consider

While there are online tax platforms, finding a good accountant can provide peace of mind (and explanations that you might need)

Everyone should have a Government Gateway account, which enables you check your Income Tax estimate and tax code, check your income from work in the previous 5 years - and more!

Remember, this is just a summary of our discussion. This is all subjective - and in no way constitutes financial advice.

Quick links!

Ahead of the UK General Election on 4 July, Labour vs Conservatives: What are their policies?

A survey suggests that most Brits seem to be unaware of, or worse, dangerously underestimate the true cost of retirement

Best online shopping practices, email marketing tactics, how to quell (or at least abate) anxiety shopping - there has to be a better way to shop online (Apple / Spotify)

A new start after 60: after a decade of rejections, I got my first novel published. Now I’ve got my dream, I won’t stop! Writer Melanie Cantor’s third novel is now out (and this article has inspired me to add her to my ‘fun reads’ list)

The next Money Brunch event will be on Saturday 22 June! Join us? Sign up here.

This newsletter will return to its usual format next week 😊

The NHS was set up after WWII - a completely different time, with different requirements, including treating mass casualties (from air raids and returning service people).

Dividends earned from a stocks and shares ISA, or interest on savings in a cash ISA are protected from the taxman. Anything in an ISA is tax free.

Great write up and action points for all from a great money brunch meet up!